Targeting the Right Consumers with Experiential Benchmarks

How Demographic Profiling Benchmarks Increase the Rate of Successful Experiential Consumer Targeting

![]() Video Length: 2 minutes 32 seconds

Video Length: 2 minutes 32 seconds

Just like buying media from magazines, radio, or television, sampling activations have consumer targets they’re trying to reach. Above all, in this use case scenario, we’re going to look at how to find these target consumers with benchmarks to maximize your reach quality.

Table of contents

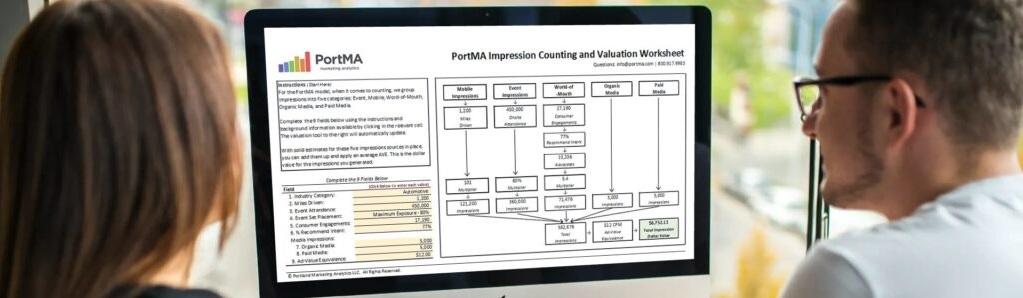

Calculate and Value Five Types of Experiential Impressions

This tool has been designed to assist with the value calculation for five impression types: Mobile Impressions, Event Impressions, Viral Word-of-Mouth, Organic Media, and Paid Media.

Frequently Asked Questions

Just like buying media from magazines, radio, or television, sampling activations have consumer targets they’re trying to reach. The prevalence of different consumer targets tend to vary by venue type. For example, you are more likely to encounter a younger consumer during a street intercept than when activating in retail.

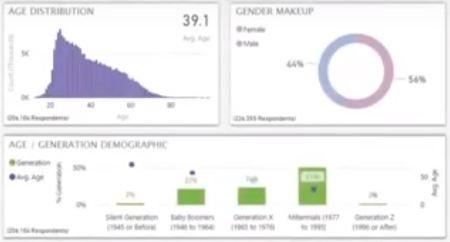

PortMA’s benchmarking database for CPG Food and Beverage experiential activations where a juice or juice drink was sampled in retail saw the average age of consumers who sampled the brand at 38.5 years of age and skewed 81% female.

PortMA’s benchmarking database for CPG Food and Beverage experiential activations where a juice or juice drink was sampled during street intercept activations saw the average age of consumers who sampled the brand at 29.6 years of age and skewed 52% female.

Video Transcripts – Experiential Consumer Targeting

Estimated reading time: 5 minutes

Just like buying media from magazines, radio, or television, sampling activations have consumer targets they’re trying to reach. Above all, in this use case scenario, we’re going to look at how to find these target consumers with benchmarks to maximize your reach quality.

00:14 Using Benchmarks for Experiential Marketing Venue Selection

The quality of your experiential activation isn’t just about the number of people you get to, but it’s about how often you’re getting to the right person as well. Getting to the right person is so much easier when you know where those people tend to go.

Subsequently, this is where PortMA’s Experiential Benchmarking Industry Reports and BI Dashboards come into play. We look back at tens of thousands of activation days, segment by venue, industry, and/ or market, and identify consumer prevalence by age and gender demographics.

00:40 Example of How to Target Particular Consumer Demographics With Benchmarks

For example, let’s say you’re developing or even trying to defend a routing schedule. Maybe the Juice Brand Team your working with needs to target women age 35 to 40 years old. You’re recommending retail, but the brand team likes the idea of street intercepts.

We do this by focusing on our CPG Food & Beverage data, honing in on Nonalcoholic Beverage, then further refining things for just Juice and Juice Drinks. Once there, we select two different venue types… Segment A: Retail and Segment B: Street Intercepts.

01:13 How Age and Gender Differ When Comparing Retail to Street Intercepts

Firstly, for retail activations, we see that the average age trended toward 38.5 years old, fitting nicely within our target age range, and retail skewed 81% female, just as we’ve been asked to target. On the other hand, for street intercepts, we see that age tends to be younger at 29.6 years old, below our age target. And while majority-female at 52%, it’s much closer to a 50/50 split.

What can we conclude? More specifically, how do these benchmarks help us with our strategic direction? Well, it starts to become pretty clear that your recommendation might be the better one. By going with retail, YOU increase your likelihood of reaching the target consumer more often. Maybe develop a campaign that is heavy retail but tests some street intercept activations. Either way, you’ll be getting to the right consumer more often because you have the insights generated from tens of thousands of activation days.