Experiential Marketing ROI Crash Course

An Introduction to How Exceptional Experiential Marketers Measure Multi-Million Dollar Marketing ROI Campaigns

![]() Video Length: 8 minutes 33 seconds

Video Length: 8 minutes 33 seconds

Start here! This 8-minute video will give you an overview of the PortMA Measurement and Benchmarking strategy. This video will give you some context for the other videos and, really, PortMA’s overall approach to measurement.

Table of contents

- Experiential Marketing ROI Crash Course

- Calculate and Value Five Types of Experiential Impressions

- Frequently Asked Questions

- Video Transcripts

- 00:32 – Three Questions to Guide Your Experiential Measurement

- 01:12 – Why Experiential Marketing works

- 01:53 – How Experiential Marketing Drives Purchase

- 02:52 – Measuring Change in Consumers Across The Purchase Cycle

- 04:06 – How “Reach” and “Impact” Come Together to Measure Experiential ROI

- 04:17 – PortMA’s Experiential Marketing ROI Model

- 05:30 – Generating New Customer Dollar Value

- 06:32 – Segmenting ROI for Experiential Insights and Actionable Data

- 07:36 – The Marketing Agencies and Brands Who Use This Experiential Marketing ROI Methodology

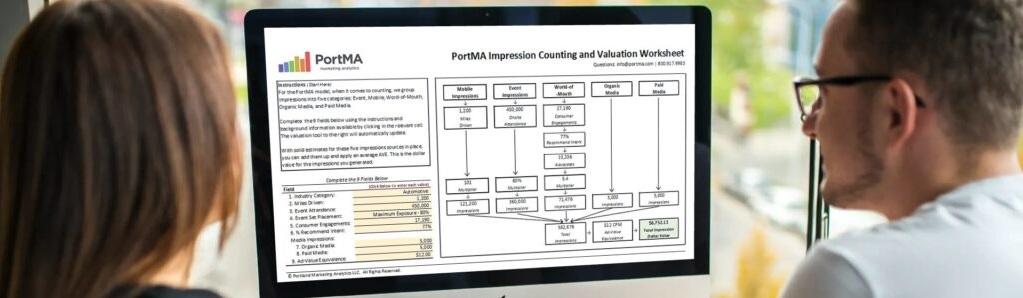

Calculate and Value Five Types of Experiential Impressions

This tool has been designed to assist with the value calculation for five impression types: Mobile Impressions, Event Impressions, Viral Word-of-Mouth, Organic Media, and Paid Media.

Frequently Asked Questions

We believe you need to focus your experiential and event data collection around three key questions: 1) “How often am I reaching the right consumer?”, 2) “Am I creating intent where it didn’t previously exist?” and 3) “Under what circumstances is the return-on-investment (or ROI) highest?”

Regardless of who you’re trying to reach with your marketing, there is a reason why 100% of this target consumer group is not buying the brand. And that reason is always that the consumer is stuck at some stage in the purchase process. Why they are stuck is often called the “Marketing Challenge.” Good marketing “un-sticks” them.

Your marketing “reach” is the number and type of people you “touched.” It’s the experiential equivalent of “GRP” or “Gross Rating Points,” and it is defined by your impressions, interactions, and sample counts, as well as the demographic and psychographic profile of your event patrons.

The impact is a measure of the change the marketing created. It is measured in the context of changes in attitude and behavior. When measuring direct behavioral changes are not possible; future intent can be measured and modeled to reflect actual behavior accurately.

Value comes from the merging of reach and impact to derive a monetary value. When this monetary outcome is modeled against program spend, the resulting measure is the “Return-on-Investment” or ROI. See the video above for an example of how the dollar ROI of Experiential Marketing is calculated.

Video Transcripts

Estimated reading time: 12 minutes

Hello Experiential Marketers. The fact of the matter is we all know that experiential marketing is a revenue-generating tool for the brands we all serve.

00:32 – Three Questions to Guide Your Experiential Measurement

At PortMA, we’ve been measuring experiential marketing for agencies and brands since 2010 and cracked the experiential ROI code when we focused on answering three questions.

Question 1: Consumer Reach

The first question has to do with your marketing reach where we work to answer the question, “How often am I reaching the right consumer?”

Question 2: Campaign Impact

Next, we need to understand how well we’re creating intent where it didn’t previously exist. This is going to be our impact measure, the outcome we’re seeking to drive.

Question 3: Marketing Value/ ROI

Finally, we can bring these reach and impact measures together to talk about value in a real, tangible way by asking, “Under what circumstances is the return-on-investment (or ROI) highest?

When you can measure, track, and react to your performance against these three questions, you’ll be working in a value-centric manner and thus acting as a true steward of the brands you serve.

01:12 – Why Experiential Marketing works

Let’s start by taking a brief step back and talk first about the job of marketing in general. Every brand has a particular consumer in mind when developing itself. This may be Moms with young children in the household. It could be twenty-something, outdoorsy men. It might be young professionals working in human resources. In marketing research, we call these groups demographic or psychographic profiles. These groups are the root of any consumer segmentation and at the core of the “identify” a brand works to create.

Regardless of who you’re trying to reach with your marketing, there is a reason why 100% of this target consumer group is not buying the brand. And that reason is always that the consumer is stuck at some stage in the purchase process. Why they are stuck is often called the “Marketing Challenge.” Good marketing “un-sticks” them.

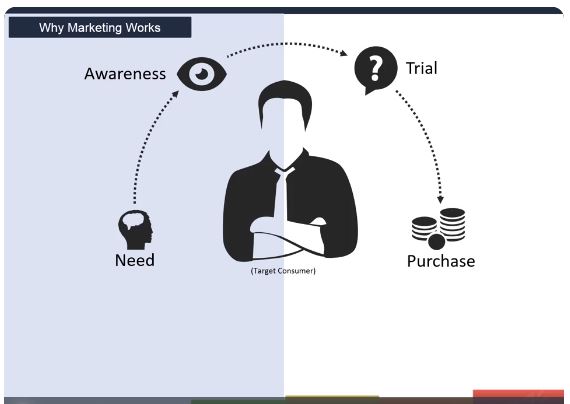

01:53 – How Experiential Marketing Drives Purchase

So what is this purchase process? When any of us decide to do anything, we must work through a four-stage process. Buying a product or service is no exception.

Stage 1: Need/ Problem Identification

It starts with “need.” We must have the problem the brand solves. For the brand to even be in our consideration set, we need to identify with the solution. And that happens once we’ve identified the problem or have the need.

Stage 2: Brand Awareness

Next, we must be aware that the brand is associated with the solution. Furthermore, we have to know and believe in the creditability of the “Brand Promise.” This is the suggestion that if we were to engage the brand, we’d have a solution to our problem.

Stage 3: Product Trial

Third, we need to get a “taste,” sometimes quite literally, of what the solution will feel like. Call it a trial run. But we (or the Consumer) must know that the solution is right. Before giving up our hard-earned dollars or valuable time and effort, the brand needs to show us that we’re not being conned.

Stage 4: Brand Purchase

Finally, we need to experience the solution and indeed realize that solution. All the work done to set our expectations needs to align with our experience to become a buyer of the product or service and a loyal customer.

02:52 – Measuring Change in Consumers Across The Purchase Cycle

So the indicator that your marketing is working and that it’s moving consumers through the purchase cycle is evident when you can measure consumer attitude or behavior across this cycle.

Good marketing will change attitudes among consumers stuck in the “Need” and “Awareness” stage. Likewise, good marketing will change the behavior among consumers stuck in the “Trial” or “Purchase” stage. When you know where the consumers are in the purchase cycle and how you’ve influenced attitude or behavior, you can start to get a clear picture of your marketing program’s value to the Brand.

Your marketing “reach” is the number and type of people you “touched.” It’s the experiential equivalent of “GRP” or “Gross Rating Points,” and it is defined by your impressions, interactions, and sample counts, as well as the demographic and psychographic profile of your event patrons.

The impact is a measure of the change the marketing created. It is measured in the context of changes in attitude and behavior. Direct behavioral changes are not possible; future intent can be measured and modeled to reflect actual behavior accurately.

04:06 – How “Reach” and “Impact” Come Together to Measure Experiential ROI

Value comes from the merging of reach and impact to derive a monetary value. When this monetary outcome is modeled against program spend, the resulting measure is the “Return-on-Investment” or ROI. So… let’s look at an example of how ROI is figured.

Measuring experiential marketing is about applying these ideas to your activations. It’s about knowing who you reached, how you impacted them, and how reach and impact came together to deliver a dollar value greater than what was spent to create the engagement in the first place.

04:17 – PortMA’s Experiential Marketing ROI Model

It starts with a typical activation day where consumers are exposed to your campaign. Let’s say, hypothetically, that this day had 204 exposures based on your signage, footprint activation, media, and other sources. And from those exposures, you were able to engage 26% of them for 53 total consumer engagements. And to take our example further, let’s say your onsite survey work told you that 85% of them, or 45 of those 53 people, didn’t currently buy the brand you were promoting. These were non-customers and represent the basis for incremental future revenue. And let’s assume you’re brief onsite survey from a cross-section of engagements showed that 78% of those non-customers left the footprint with a self-reported intention to buy the product in the future. We’re now left with 35 potential new customers.

We know that people won’t always do what they say they’re going to do but what if 60% actually did buy. There is a great body of academic research on what this percentage should be but let’s assume it’s 60% for our example here. We’re now left with 21 estimated new customers. And that leaves us with a basis from which to understand, in real economic terms, what the impact of our event could be.

05:30 – Generating New Customer Dollar Value

And these new customers generate a dollar value. It’s done with simple math. Let’s start by estimating the value per customer. For purposes of example here, let’s assume a $30.40 annual value. There are many ways to figure this but here, let’s say that the average customer buys 4 SKUs per year at $7.60 per SKU; 4 buys times $7.60 = $30.40. Multiply 21 new customers at an annualized value of $30.40 each, and you get to $638 in incremental revenue delivered for that one day of activity. If that day of activity costs $551 to pull off, you’re looking at an ROI of around 116%. Easy right? Let me let you in on a secret that most of the industry doesn’t yet understand as soon as you get to the point where you have this number. This 116% ROI… you’ll realize it doesn’t mean anything. Sure, you’ll wipe the sweat from your brow that it’s positive, but in of itself, it’s meaningless. It’s not actionable. To make it actionable, you need to segment it and compare it to benchmarks.

06:32 – Segmenting ROI for Experiential Insights and Actionable Data

Here is what ROI looks like when it’s segmented. You might organize your ROI by Event type, where you segment your data by NASCAR, Festivals, and Street Intercepts. You might break it up by markets such as Massessechuets, Ohio, and Texas or event by staffing scenarios like single person events, two staff, or three or more staff on site. And “sampling strategy,” where if you were talking wine, you might organize your data by varietal segmenting by White, Sparkling, or Red.

This is where it becomes actionable! All of a sudden, it becomes clear that NASCAR is outperforming Street Intercepts significantly. It looks like those extra venue costs are paying for themselves. And Texas is certainly outperforming Massachusettes; maybe that pre-activation social push had an impact after all. It looks like we weren’t getting to enough consumers when we staffed with just one person and those two-person events were truly optimal. Three people staffing an event doesn’t seem to be worth the extra costs. And Red is really outperforming white. We knew the white was going to be hard to chill. It looks like this is having a bigger impact than we suspected. These are real, actionable consumer insights. This is how you measure experiential.

07:36 – The Marketing Agencies and Brands Who Use This Experiential Marketing ROI Methodology

These are the measurement strategies used by the agencies you know. Since 2010, PortMA has been behind the scenes designing the measurement strategies, collecting the data, conducting the analysis, and delivering status reports and program recaps that deliver actionable roadmaps that drive future campaigns. And we’ve been doing this for brands directly or through their agency partners for some of the industry’s most iconic brands. This is a measurement strategy that works across consumer package goods, adult beverages, insurance, finance, and household products from over-the-counter to frozen pizza. We’ve even deployed these methods for several branches of the U.S. Military.

Browse PortMA’s use case scenario videos to gain an in-depth understanding of how these methodologies can make you a smarter marketer, win you more business, and generally help you deliver a better campaign for your Client or manager. Or reach out directly if you’d like to learn more.