I’d like to share with you something that really gets to the heart of PortMA’s methodology when tasked with the challenge of measuring experiential marketing. There is a core set of three questions we use to guide the data to be collected, the analysis to be done, and the reporting to be completed.

Estimated reading time: 5 minutes

Real-Time Measurement Metrics

Everything that a creative department can possibly come up with – and all the possible ways that you might collect data around that – start to come into focus on and settle down into one approach, one theory, and one set of ideas that are guaranteed to be actionable.

I’m not just talking about actionability where everything is said and done; when three months past the end of the activations people will move on to other things. I’m talking about actionability in real-time. I want data as it’s coming in for you to be able to see, understand it and react to it in a way that’s going to give you time to make the marketing better before it’s too late to fix things.

Start with the Questions

When you’re done, and you’re in the recapping stage, these three questions really will drive consumer insights and strategy. This idea that insights and strategy are something that’s static is such a failure of thinking because insights and strategy are very specific to the team that’s looking to execute. The questions can be standardized, but then how you apply that to those folks and how you think about that is going to be very unique for different individuals. You have to address that in the delivery of your analytics and delivery of your data.

These three questions are a great starting point. I’m not saying that experience or measurement shouldn’t go beyond these three core questions. It certainly may and oftentimes should. However, when there is no other direction, you need to start with these three questions in mind.

(You can listen to the full podcast episode below.)

What Not To Do

The problem with almost every methodology or data collection effort that I see (that doesn’t start with this kind of focus) is that people don’t really know what they’re going to be doing. They don’t really know how or what they’re going to see when they’re done.

Some ask every question they could think of either in a consumer survey or as a recap template for the field staff to complete after each day of activity. Others think of every possible KPI; every possible metric. They get it into a system. Through stick and commitment, they just drive people to answer all those questions throughout the three-week, three-month, or 12-month campaign.

When they’re done, they will dump that data on an analyst and someone will find value in there. The recap will help show it was worthwhile, and that’s an understandable approach. But, it’s an immature approach.

We need to have a plan in mind before we start. We need to know what we’re going to do with that data before we start collecting it.

We’ve been focused on the three questions for the last 10 years and we’ve used them to measure and guide the measurement of literally hundreds of experiential marketing campaigns. And it’s worked every time.

Measuring Experiential Marketing

The first question has to do with consumer reach. How often am I reaching the right kind of people? There’s both a quality and a quantity component to this. Let me start with the quantity component because that’s something that you’re probably very familiar with. It’s certainly the number of people that you reached, the number of samples you handed out, and/ or the number of people engaged. It’s the things you did with them when you were on site. I often think about engagements as the headcount and interactions; the things that were done when they were on the locations. One person could have multiple interactions but it would be one engagement.

How often am I reaching the right kind of people?

As multiple interactions start to develop, you start to get a level of immersion. If they did one thing on-site versus four things on-site, those are degrees of immersion with that engagement. Sometimes that can be a very strong, independent variable or very telling in your analysis, but there’s a quantity measure. That quantity measure, the number of people you got to, can be divided by staffing hours. Or, you can divide that by event days and segment it by type of activation.

You start to get a clear measure of efficiency. What emerges is a really good understanding of the circumstances where you are more efficiently engaging more consumers than others. We see those statistics often in our recap reports when we are measuring experiential marketing.

Experiential Reach

There’s a more important component to that and it has to do with the consumer targeting; how well you’re reaching the right kind of person. If you’re reaching the wrong person very efficiently, it doesn’t matter, you’re not going to have any impact.

Reaching the right kind of person is often defined by demographic profiles. It’s really the assumptions that you had when you selected that venue, that location, or that sponsorship. That type of venue or that type of musical act or that location – the destination – in and of itself attracted people that fit the consumer profile you were trying to reach.

Whether or not you were correct, how well you reached that right kind of person, and how often and how efficiently you reached that person is as important as the broader numbers of total samples you distributed.

Aligning with the Marketing Mix

The first question is: how often am I reaching the right kind of person? The secondary value of this approach is that it will appeal to folks that think about marketing in the context of media buys.

When we’re buying media through radio, print, and television, we’re thinking about what channel we are targeting and how we are reaching consumers through that channel. The channels we’re choosing are related to different demographic profiles and that’s the way we’ve always purchased media.

We can think about experiential in the same context, then it doesn’t stand out as a thing that’s being measured outside of the marketing mix. It’s actually an important part of the marketing mix for the brand. It helps align with more traditional techniques of measurement as well.

Next, we’ll talk about the second question, “How often are we creating intent where it didn’t previously exist?”

Further Reading

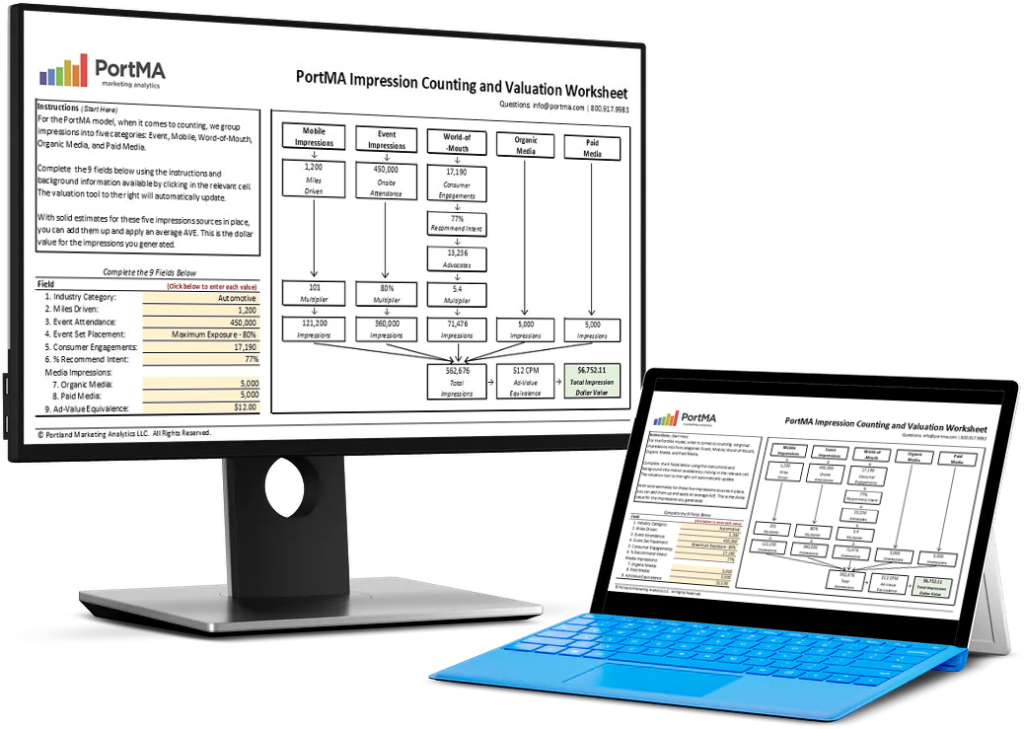

Download the Free Spreadsheet Tool

CALCULATE THE DOLLAR VALUE OF EVENT IMPRESSIONS

PortMA Impression Counting and Valuation Worksheet

Download this spreadsheet and complete the fields for your campaign to get a clear count of your activation impressions translated into a Dollar Value of Marketing

Impression Spreadsheet