There is a point at the end of the year or the end of a project when we are all reviewing how well we have served our clients, how happy we kept our employees, what worked and what did not. Satisfaction research can help you answer all those questions, and here is how.

Estimated reading time: 3 minutes

Satisfaction or Dissatisfaction?

We all love the feeling that comes from receiving compliments. It’s great to get a pat on the back from time to time, but here is the problem: understanding what you are doing well is completely unactionable.

The only thing you get from listening to compliments is an idea of which activity to repeat. So, satisfaction research should really be thought about as dissatisfaction research. The secret to actionable brand health, client or customer satisfaction, or loyalty research is to find the pain points – without causing PR issues or eroding internal morale.

Take a look at our process.

Make it Worth Their While

(Dis) Satisfaction research starts with an email invitation to complete a survey. Ideally, this email should come from someone in a senior leadership position who is widely recognized. It’s a great way of showing how much the research matters to your business.

However, it is rarely enough to generate great response rates. For most, you need to incentivize respondents and approach your research with realistic expectations. Incentivizing can take different shapes. In some cases, knowing why the research matters may provide a strong enough value proposition. In others, it is worth offering something like a chance of winning an Amazon voucher.

Within a B2B context, a 10% response rate is great. This moves up to 20% and beyond for B2C research. 30% would be outstanding. Even employee research does not necessarily lead to 100% response rates; 60% is more realistic.

Assuming your audience has opened the email and clicked on the survey, now is the best time to look at specific questions.

(You can listen to the full episode of the podcast below.)

What You Need to Ask

Opening by asking about problem areas is daunting. But it is near impossible to have a perfect customer relationship without any concerns. Stating this in your survey simply acknowledges that you understand brand relationships. The next step is to allow respondents to choose from different areas where concerns arose.

Whilst each business is different, some areas tend to apply to many, including:

- Information gathering process

- Purchasing process

- Delivery process

- Follow-up processes, such as customer service

Divide your survey into four or five sections that apply to most respondents.

Details Make a Difference in Satisfaction Research

With the overall sections defined, it is time to get into more detail. Under each section, identify three or four points that could go wrong and state them clearly and factually. Brief language helps with hitting the right tone.

Invite respondents to check any issues that may have applied to them over the past six or 12 months. Offer an open section to allow respondents to share their own concerns. Do not be afraid to allow respondents to open up and list more potential pain points. Remember, each of those points gives you a chance to improve.

In our next blog, we will talk about how to prioritize between pain points – with the help of customer responses.

Download the Free Spreadsheet Tool

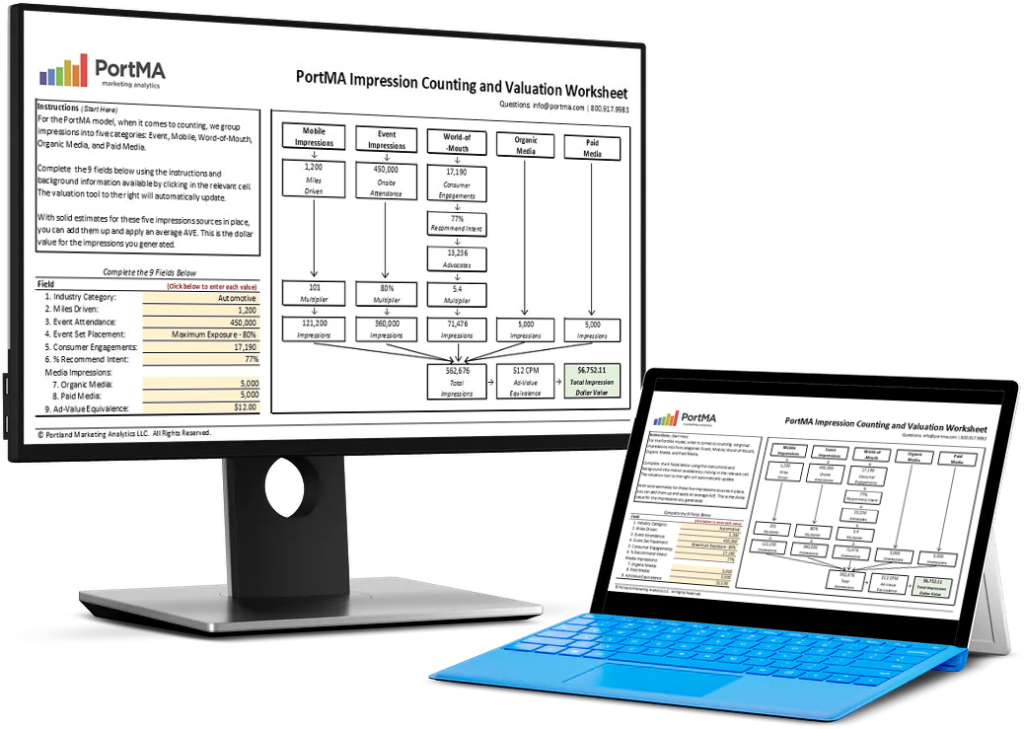

CALCULATE THE DOLLAR VALUE OF EVENT IMPRESSIONS

PortMA Impression Counting and Valuation Worksheet

Download this spreadsheet and complete the fields for your campaign to get a clear count of your activation impressions translated into a Dollar Value of Marketing

Impression Spreadsheet