We are currently working on a nationwide sampling program that focuses on different liquors. Our recent round of reporting focused on one brand. We looked for differences in consumer reach and impact before, and after, a specific series of events was executed.

Finding The Target

Research showed that our clients target consumer was reached more often at a specific series of events. This indicated that staff were maximizing opportunities to engage with the target consumer, the millennial male. There were also differences in impact metrics. We saw a small increase in purchase intent and a more pronounced increase in advocacy.

On the other hand, we also saw a shift in consumer segments. Almost twice as many current customers were reached during the event series compared to prior. As a result, the frequency of interactions with non-customers, especially those who were newly educated, decreased. That kind of shift in consumer segments typically shows a considerable increase in purchase intent. But that was not the case in this study. The reason is, non-customers, especially those who are new to the brand, tend to be more skeptical than those with direct experience, no matter how positive their event experience. When interactions with newly educated consumers decline, we often see purchase intent rates skyrocket.

Seeing Mixed Results

Not seeing this trend caused us to look further at the data. Because this is an ongoing program, we were able to look back to the previous year. The target demographic reach was relatively low compared to this year (less than half of what it is now). This was driven by consumers outside of the target profile who were more attracted to engagements and sampling the brand than the actual target.

We corroborated this finding with notes from field staff. The notes stated that the target demographic seemed to be interested in the brand, but was not excited about how it was being sampled. Research we had conducted with another brand substantiated this finding. The target consumer noted it would be a good product for the woman in their lives but it was not something they could see themselves buying. This offered further credence to what might be contributing to the high rate of advocacy for our current brand.

Altering Your Course of Action

Based on this data, we were able to identify a new opportunity for our client: create a new sampling experience that caters more to a male millennial. Finding ways to attract him to the brand by focusing on some of the factors millennials value in this product category was key. Taste profile, variety, perception of sophistication, uniqueness, and flavor were the focus. Our client was able to take this finding and use it to adjust their sampling strategy for the upcoming quarter, and used the data to help the brand team understand and buy into the change in direction.

Additional Reading

- How Real-Time Event Feedback Boosts Engagement and ROI

- How to Use MMM Frameworks to Measure Experiential Campaigns and Marketing ROI

- How Demonstrating Value Strengthens Client Relationships in Experiential Marketing

- How the RIV Paradigm Approach to Reach and Impact Drive Marketing ROI

- How Compelling Proposals Strengthen Client Relationships

Download the Free Spreadsheet Tool

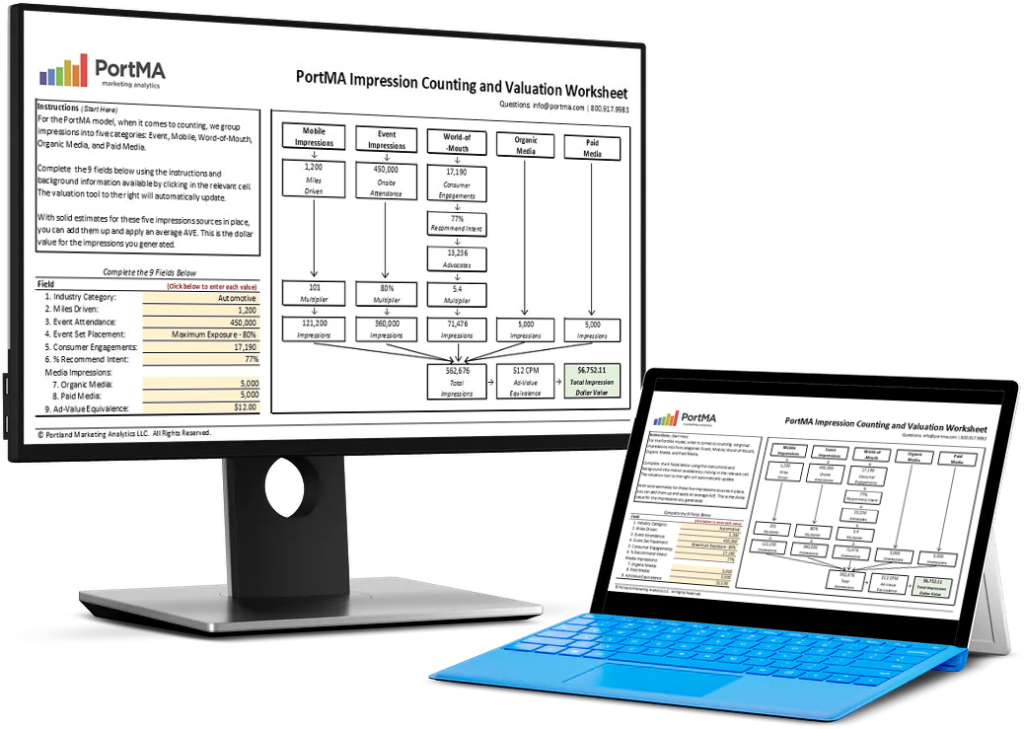

CALCULATE THE DOLLAR VALUE OF EVENT IMPRESSIONS

PortMA Impression Counting and Valuation Worksheet

Download this spreadsheet and complete the fields for your campaign to get a clear count of your activation impressions translated into a Dollar Value of Marketing

Impression Spreadsheet