Here it is – Part Two of our blog detailing the event survey questions you need to ask your potential customers to help analyze the success of your experiential marketing campaigns. If you missed Part One, you can find it here.

Estimated reading time: 3 minutes

We will dive right in:

4. Test Group vs Control Group

One characteristic of quality research is having a test group and a control group. The purest control test would be to talk to folks at the event that have had no exposure to your experiential marketing activity. You can then compare their answers to your participants.

5. Gender

In many cases, gender can be observed for the purposes of marketing. Combined with age, this is one of the most important components of consumer targeting profiles.

Having said that, if your product (or others you may want to compare the data to) has a very specific target market, it is worth recording this in more detail.

6. Age

Knowing the age of your potential consumers at an event is important from a marketing as well as a legal perspective, especially if you are working with products like alcoholic drinks. That is why it is important to ask that question by way of gatekeeping.

As mentioned above, combined with information about your consumers’ gender, age becomes one of the main criteria for describing your target market.

(You can listen to the full episode of the podcast below.)

7. Kids in the Household

Having kids living in the household changes family dynamics and purchasing behavior. Recording age and the number of kids in your event survey is even more important if you are marketing products to be used or consumed by kids.

8. Product Awareness

Recording product awareness allows you to distinguish between current customers and non-customers. Distinguishing between product awareness and purchasing helps you narrow down your campaign’s return-on-investment (ROI). You can take current customers out of the mix and better understand the performance of your activity.

9. Purchase Intent

Our last two measures refer to the third question posed in Part One of this blog. How you approach these will depend on how far along the purchase cycle your customer is.

When considering purchase intent, you are not always asking a yes or no question referring to the very near future. If the star of your experiential marketing campaign is of high value, you may be looking to record whether your product will be part of the consumer’s consideration set.

10. Advocacy

At the same time, it is worth measuring advocacy. Are your event’s participants likely to talk about your brand? Perhaps they do not currently intend to purchase the product, but if they are likely to become an advocate, then you have had an impact.

11. Type of Event

Distinguishing by event type may seem tricky at first, but once you develop a few categories for the types of events you regularly use, it becomes truly useful. Activation will differ from sports events to food festivals or an event at the local zoo, for example.

Of course, you can add other metrics and alter these to better suit the brands you work with. These event survey metrics will allow you to collect meaningful survey data from your experiential marketing activity to analyze in the future.

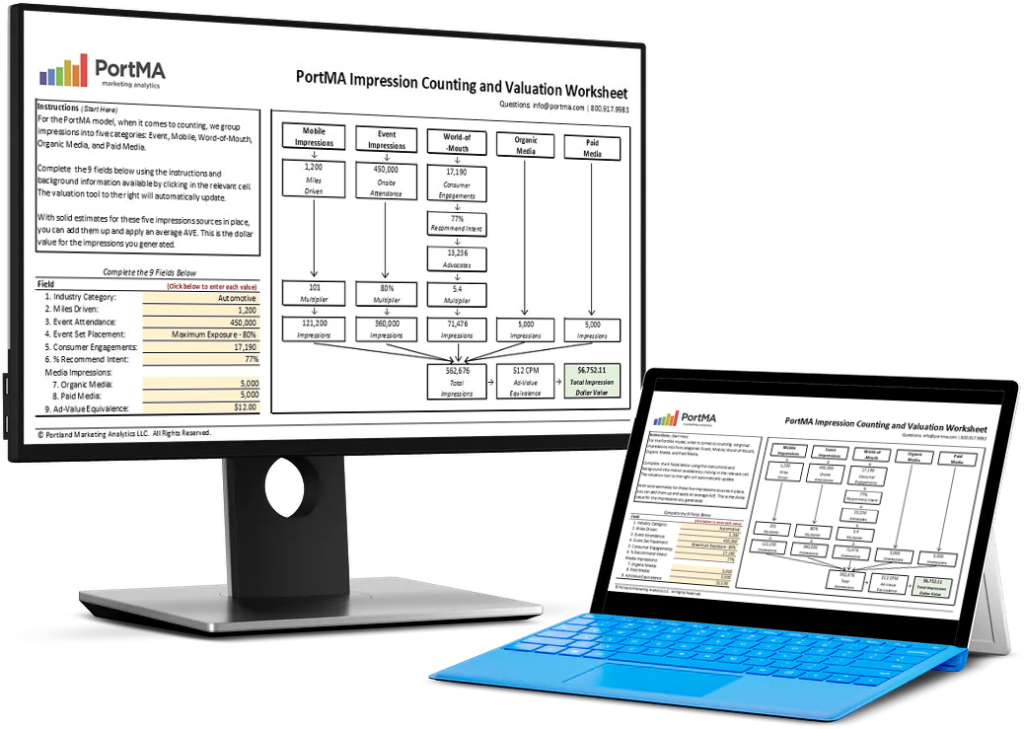

Download the Free Spreadsheet Tool

CALCULATE THE DOLLAR VALUE OF EVENT IMPRESSIONS

PortMA Impression Counting and Valuation Worksheet

Download this spreadsheet and complete the fields for your campaign to get a clear count of your activation impressions translated into a Dollar Value of Marketing

Impression Spreadsheet