Part One of this blog focused on working with brand ambassadors to reach consumers for adult beverage marketing. In Part Two, we’ll look at a few more examples of how to measure the impact of on-premise experiential marketing, starting with trade contacts. When done properly, putting data at the heart of your experiential marketing strategy helps you hit and extend your reach with every activation.

If you missed Part One, you can find it here.

Estimated reading time: 3 minutes

How Brand Ambassadors Can Work With Trade Contacts

Adult beverage brand ambassadors working with trade contacts often need more in-depth knowledge than ambassadors working with consumers in small music venues, for example. In one of our most successful activation campaigns, we started by doing a national survey of bartenders.

Rather than asking marketing-specific questions, we wanted to understand baseline opinions and assumptions about this type of product among trade contacts. How did they feel about the spirit and the manufacturing? What was their likelihood to pour one type of whiskey over another?

The survey gave us a national average which we then compared to bartenders who had worked with brand ambassadors. The differences were striking, and across the board, brands benefitted from using ambassadors.

(You can listen to the full episode of the podcast below.)

Understanding the Importance of Menu Placement

Bar menus are another fascinating aspect of the work experiential marketers are doing for different brands. To gain a better understanding of what different brands were doing, we analyzed 3,800 menus from across the country and coded them into over 118,000 drinks.

Based on that, we broke the data down by manufacturer, supplier, region of the country, and even the description of the drink. Apart from understanding which drinks were the most popular, we learned much more. We saw that different brands took very different approaches to menu placement. The conclusion was obvious – an approach that worked well for a whiskey brand was not necessarily right for a tequila brand.

What’s even more interesting is that we could take that information back to the brand ambassadors. They could take to their contacts about how to approach different spirit categories to maximize revenues.

What About the Customers?

The spirits industry relies heavily on having a strong message-to-market match. Brands need to reach consumers at a stage in their life when they are ready to engage with a specific drink. As somebody gets older, they’re likely to find stronger-tasting spirits more attractive. Younger consumers tend to favor something milder and easier to drink.

Younger consumers are also more likely to explore a new drink rather than older consumers. Compared to older consumers, their younger counterparts are likely to try a much higher number of different spirits in a given year.

Knowing this allows experiential marketers to align brands and consumers. Understanding the data behind the experience will help marketers deliver an experience that generates the type of loyalty a brand is looking for. This loyalty will always need to align with your messaging and your value proposition. Not measuring these criteria leaves you stuck with guesswork, and you may be missing your mark.

Download the Free Spreadsheet Tool

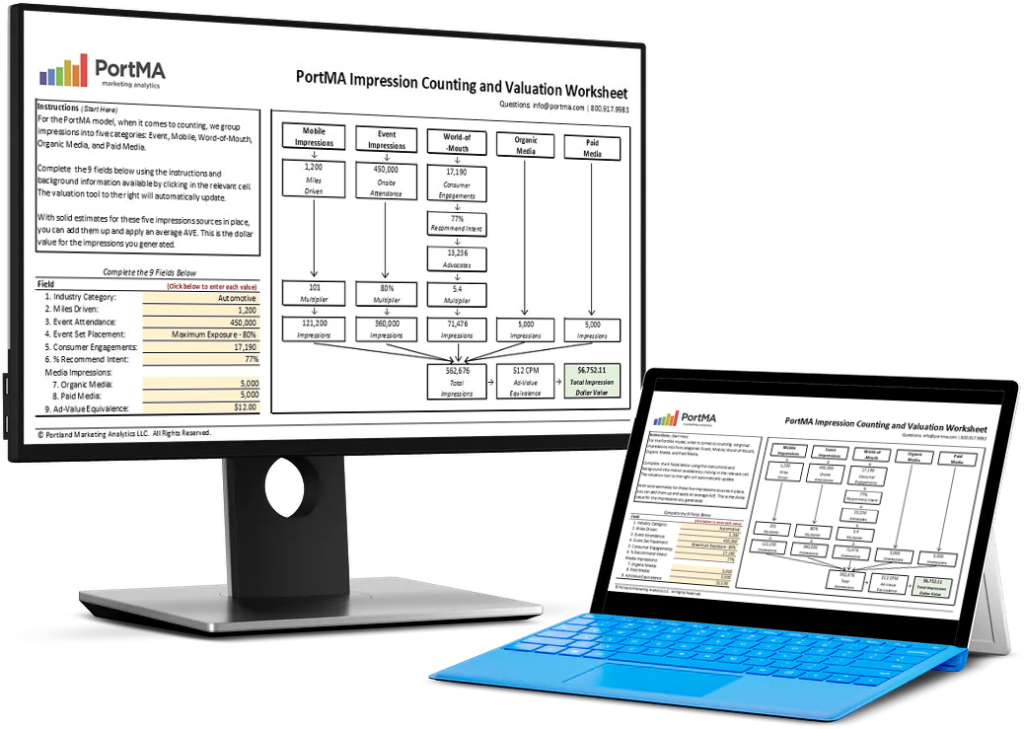

CALCULATE THE DOLLAR VALUE OF EVENT IMPRESSIONS

PortMA Impression Counting and Valuation Worksheet

Download this spreadsheet and complete the fields for your campaign to get a clear count of your activation impressions translated into a Dollar Value of Marketing

Impression Spreadsheet