How will these reports benefit me?

Use case scenarios (and how to apply them to your business) are detailed in each report. Below are some of the common applications of experiential ROI benchmarks:

- Designing a Winning Marketing Campaign

The best predictor of the future is the past. And when you can plan based on a well-organized set of data that benchmarks this history, you can create a campaign that will get it right more often from the start. You’re moving your marketing downriver faster because you can use benchmarks to identify the venues that have your consumer target and strike a stronger balance between “event size” and “event frequency”. - Selling Your Experiential Campaign to Stakeholders

We’re all always selling. It doesn’t matter if you’re a Brand Manager talking to your VP or if you’re an Agency Director talking to your Brand Client. You need to demonstrate that your reasoning is sound, and your plan is positioned to be a success. Experiential marketing benchmarks allow you to differentiate yourself from the external and internal competition and demonstrate the value before the money is spent. - Negotiate Better Venue and Sponsorship Agreements

The right benchmarks will give you a point of reference when speaking with venue managers or when developing sponsorship agreements. You’ll be in a stronger negotiating position with data on your side because you can validate venue manager and producer performance commitments and choose the best sponsorship package. - Validating a Proposal’s Performance Promise and Budget

A solid benchmarking resource will allow you to validate an outside agency or vendor’s plan. We recommend that you consult the right benchmarking tables in your report anytime you’re evaluating an experiential activation strategy; validate agency performance commitments and evaluate a campaign’s budget before committing. - Managing Campaign Performance

When you have performance benchmarks from dozens of experiential programs you know what to expect. The proper use and application of experiential benchmarks will allow you to establish the right Key Performance Indicators (KPIs) to evaluate campaign performance during execution and recap your program when it is complete.

What do I receive when I purchase a report?

Each report purchase includes three documents and support from our research team to ensure you get the solution you need.

- Experiential Marketing Industry/ Venue Benchmarks Report (Fully Indexed PDF)

First, you’ll receive a comprehensive PDF that provides a full background on the data collection methodology and the related experiential marketing strategy. This includes the data points collected, how, and why. This background provides a full outline of PortMA’s proprietary return-on-investment model. The report benchmarks define the reach, impact, and ROI trends across the industry and multiple venue types. These metrics are detailed in tables within this broader context of theory and application. - Data Tables Deck (PowerPoint Document)

Second, we summarize the experiential marketing strategy and related data with the data tables on individual slides in a PowerPoint document. This document is provided to easily pick and choose the slides that are most relevant to individual efforts. These slides can be repurposed in your own Client recap reports, RFP responses, and individual presentations. - A 1-Page Executive Summary (PDF)

Third, a top-line summary of the experiential marketing report benchmarks is presented in a one-page executive summary using PortMA’s proprietary “Scorecard Reporting” methodology. This document serves as a quick reference on the key data points and industry ROI segments. The report is designed for easy reading and distribution to internal management. It also serves as a quick reference guide.

You will also receive custom, on-call support with an Experiential Marketing Analyst Expert.

As a part of any purchase, you will be provided with an account manager who is a seasoned Experiential Marketing Data Analyst intimately aware of the report details and methodology. This individual is available to you by email or phone for a period of 12 months after the purchase to provide any training and support needs you have related to your purchase.

You are encouraged to call on your Account Manager for any of the following:

- One-on-One or Team Training

- Sales Support/ RFP Response Assistance

- Survey/ Data Collection Architecture Design

- Data Dashboard Consulting/ Wire Frame Development

- Data Analysis Assistance or Completion

- Report Development Assistance or Completion

- Client Briefing Preparation, Attendance, or Meeting Leadership

Why are these reports important?

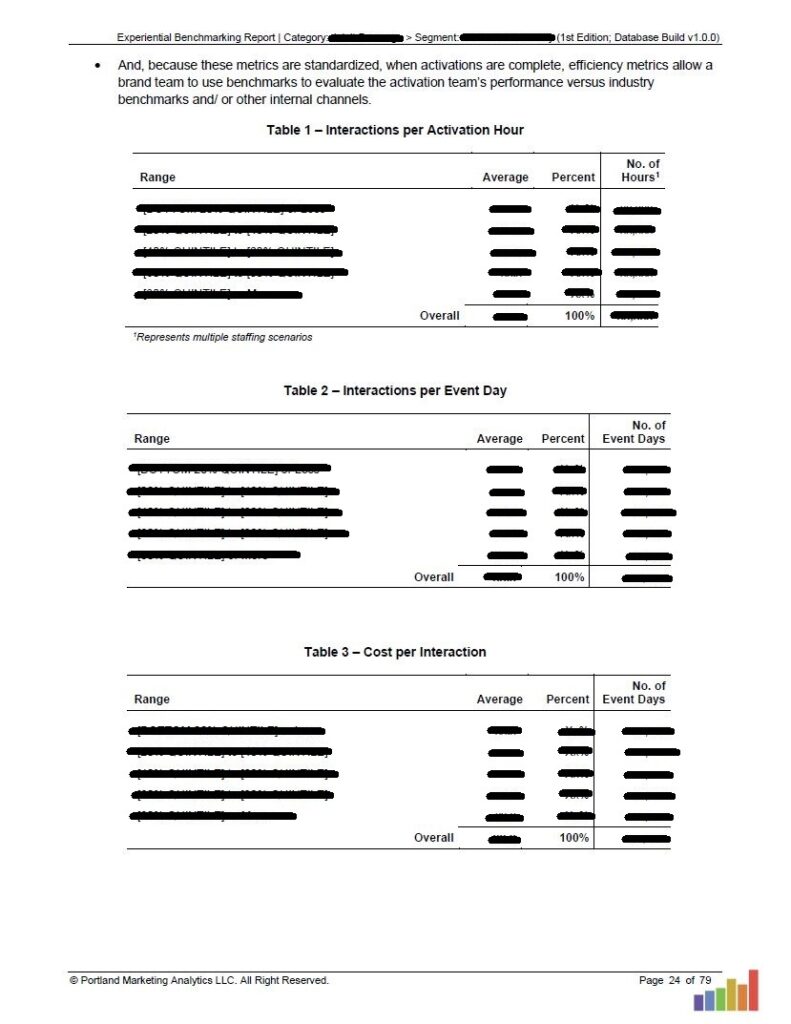

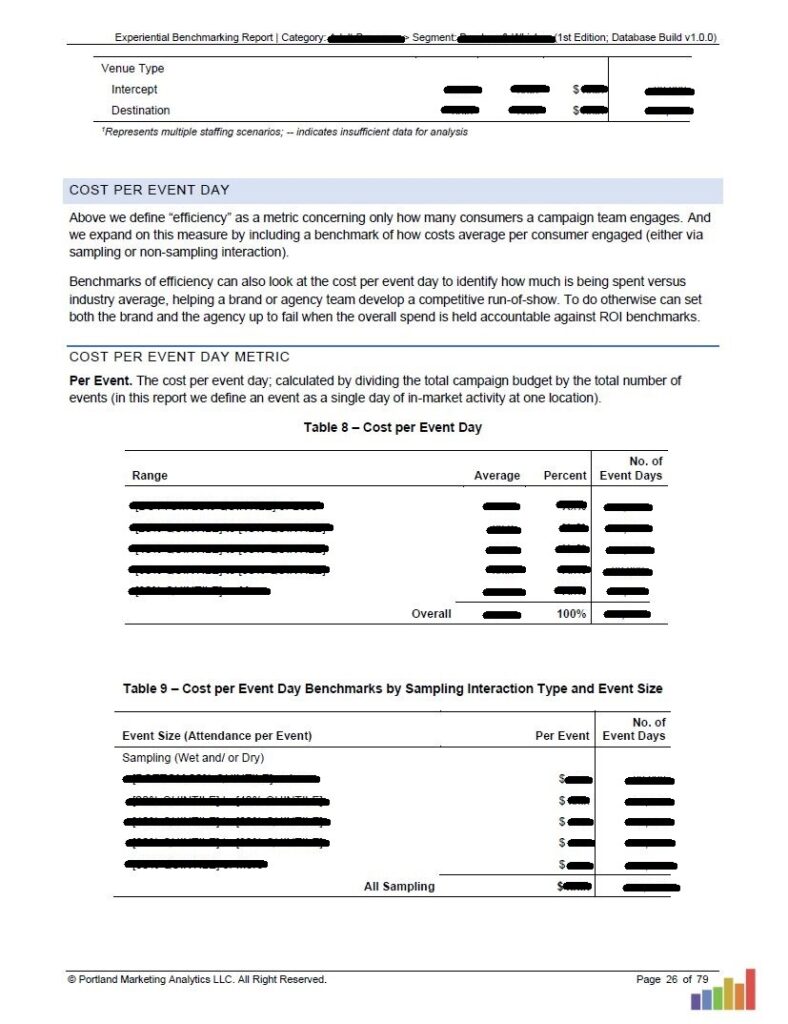

There are many business applications for the Return-on-Investment (ROI) modeling in these experiential marketing reports. At its core, ROI is an index score that represents the balance any marketing campaign struck between the number of consumers reached, how those consumers were impacted when contacted, and how much money was spent to do so.

A positive ROI indicates that more money was gained than was spent (the most basic purpose of any for-profit business). And when the component parts of any ROI are deconstructed, a marketer can identify those decisions that led to success, and those that didn’t. This empowers the marketer (or the marketer’s stakeholders) to set expectations. These experiential marketing reports help the marketer to define marketing goals that align with those scenarios that have generated a positive ROI in past marketing.

This is the source of great marketers’ power.

Can I see screenshots from a sample report?

What industry/ venue segments are available?

The best experiential marketing provides consumers an opportunity to engage with a brand at little to no cost and uncover the unique value proposition that product or service has to offer. When comparing industries the playing field is not level. The best experiential marketing for one industry will not always be the best for another.

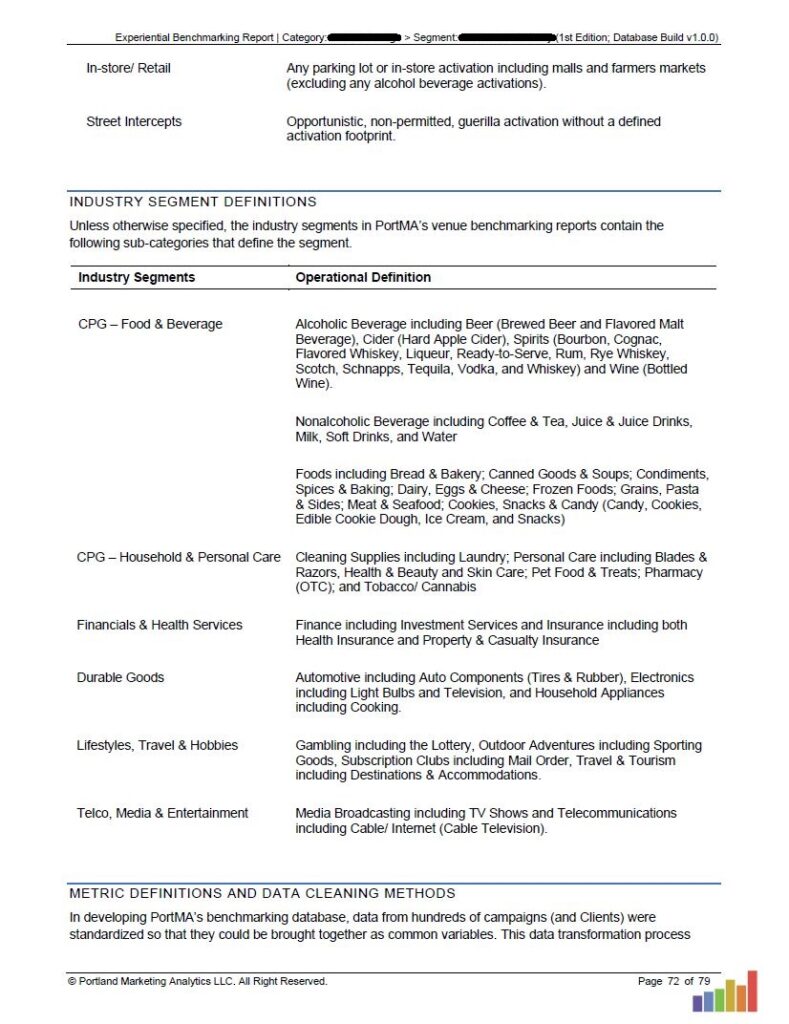

And as a result of this (very natural) industry variation, the impact and results vary greatly by industry. It is because of this that PortMA segments their Experiential Benchmarking Reports by industry into the following groupings:

List of PortMA Industry Benchmark Segments

Alcoholic Beverage

- Beer (Brewed Beer and Flavored Malt Beverage)

- Cider (Hard Apple Cider)

- Spirits (Bourbon, Cognac, Flavored Whiskey, Liqueur, Ready-to-Serve, Rum, Rye Whiskey, Scotch, Schnapps, Tequila, Vodka, and Whiskey)

- Wine (Bottled Wine)

Nonalcoholic Beverage

- Coffee & Tea

- Juice & Juice Drinks

- Milk

- Soft Drinks

- Water

Foods

- Bread & Bakery

- Canned Goods & Soups

- Condiments, Spices & Baking

- Dairy, Eggs & Cheese

- Frozen Foods

- Grains, Pasta & Sides

- Meat & Seafood

- Cookies, Snacks & Candy (Candy, Cookies, Edible Cookie Dough, Ice Cream, and Snacks)

Household and Personal Care

- Laundry

- Personal Care including Blades & Razors

- Health & Beauty including Skin Care

- Pet Food & Treats

- Pharmacy (OTC)

- and Tobacco/Cannabis.

Financials & Health Services

- Finance including Investment Services

- Insurance including both Health Insurance and Property & Casualty Insurance

Lifestyles, Travel & Hobbies

- Gambling including the Lottery

- Outdoor Adventures including Sporting Goods

- Subscription Clubs including Mail Order

- Travel & Tourism including Destinations & Accommodations.

Durable Goods

- Automotive including Auto Components (Tires & Rubber)

- Electronics including Light Bulbs and Television

- Household Appliances including Cooking.

Telco, Media & Entertainment

- Media Broadcasting including TV Shows

- Telecommunications including Cable/ Internet (Cable Television).

List of PortMA Venue Benchmark Segments

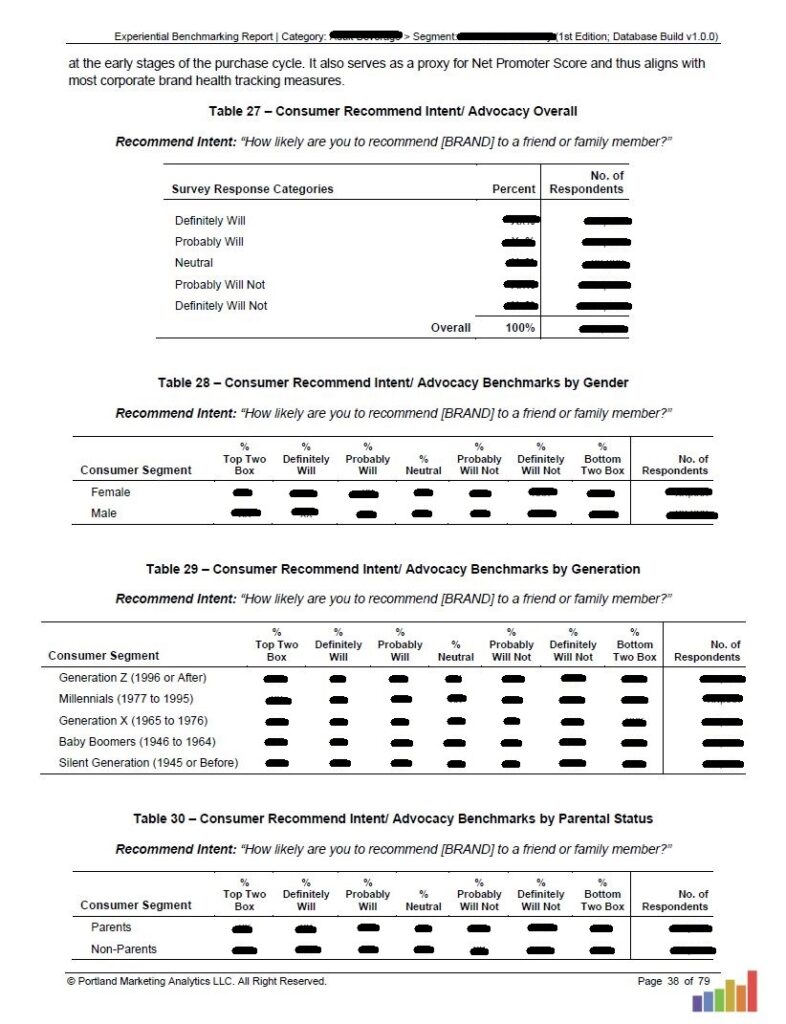

The success of experiential events (and strategic marketing in general) require careful consideration of how frequently you’re reaching the right type of consumer. Strategic marketing is about aligning your message with the right market for a clean message-to-market match. This is done with thoughtful venue selection.

Venues and destination events tend to attract similar types of people. The state fair will have more families, the music festival, younger adults. Therefore your experiential events and strategic marketing goals are reached when your routing schedule targets the venues that attract the type of people you’re trying to reach.

You’ll find which consumers are at which venue and destination event types in PortMA’s experiential marketing benchmark reports.

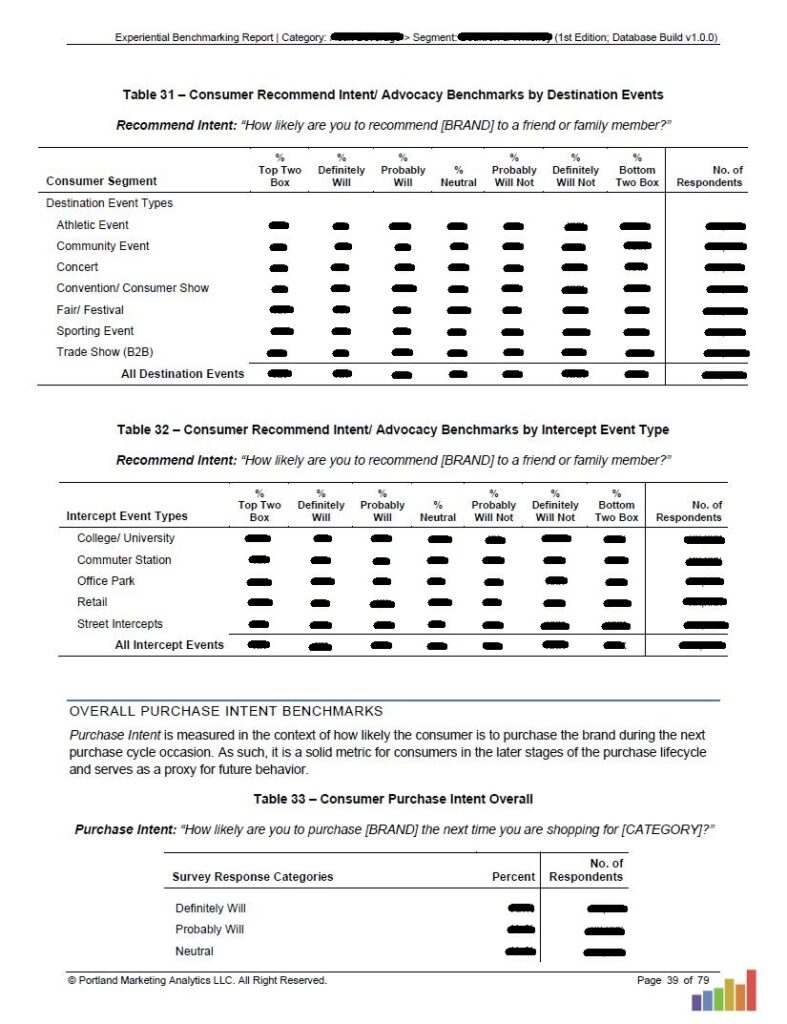

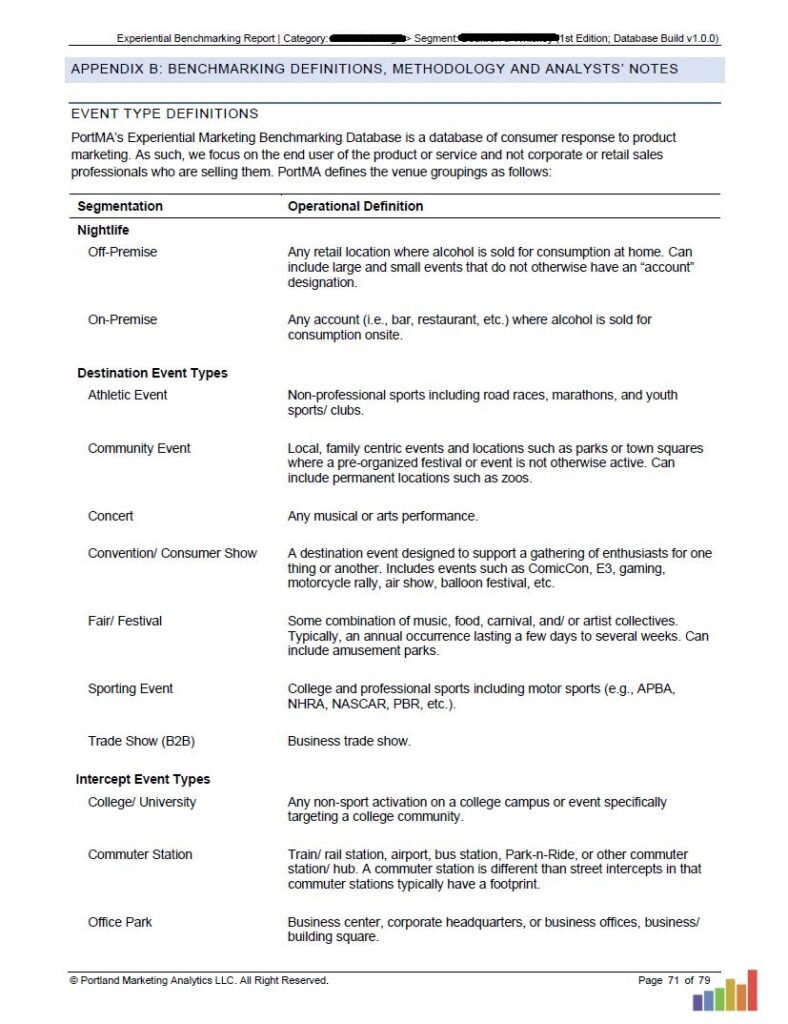

Destination Events

- Athletic Events

- Community Events

- Concerts

- Conventions/ Consumer Shows

- Fairs/ Festivals

- Sporting Events

- Trade Shows (B2B)

Intercept Events

- College/ University

- Commuter Station

- Office Park

- Retail

- Street Intercepts

Lifestyle Events

- On-Premise

- Off-Premise

What are the geographic segments?

The performance of any experiential field marketing campaign will often vary significantly by geographic region. A brand’s field marketing performance in a given market will be dependent on a number of factors including past marketing spend competitive landscape and consumer profile. It is therefore important to take these into consideration when selecting the most appropriate experiential marketing benchmarks.

PortMA segments its geographic benchmarks at three levels starting with the U.S. State where the field marketing took place. From there, the classification system identifies four regions and 9 sub-regions.

Regions (and Subregions)

- The West (Mountain States and Pacific States)

- The Midwest (East North Central States and West North Central States)

- The South (South Atlantic States, East South-Central States, West South-Central States)

- The Northeast (New England States and Middle Atlantic States)

Subregion (and Markets/ States)

- Mountain States (Montana, Wyoming, Colorado, New Mexico, Idaho, Utah, Arizona, and Nevada)

- Pacific States (Washington, Oregon, California, Alaska, and Hawaii)

- East North Central States (Illinois, Indiana, Michigan, Ohio, and Wisconsin)

- West North Central States (Iowa, Kansas, Missouri, Minnesota, Nebraska, North Dakota, and South Dakota)

- South Atlantic States (Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and West Virginia)

- East South-Central States (Alabama, Kentucky, Mississippi, and Tennessee)

- West South-Central States (Arkansas, Louisiana, Oklahoma, and Texas)

- New England States (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont)

- Middle Atlantic States (New York, New Jersey, and Pennsylvania)

If you would like access to a particular Industry, Event/ Venue type, or Geographic segment or sub-segment that you do not see listed below please contact us directly and we can build you this report in four business days.